Your credit score is critical when obtaining credit these days, yet many people are unclear about what makes up their score. Credit scores range from 300 to 900 with most mortgage lenders requiring a minimum of a 680 score. Many factors go into your score but the 2 largest contributors are how you make your payments and how much of your available credit you are using. The first is easy; make your payments on time and your score goes up; have late payments or collections and your score goes down. Any late payments stay on your bureau for years and

Read More

Posts by kelowna

Royal LePage Kelowna Real Estate Report for August 2018

Low Waste Gardening in the Okanagan

Read More

Wildfires: Impact on Buying and Selling Real Estate

Wildfires: Impact on Buying and Selling Real Estate Once again, Kelowna finds itself in the middle of numerous forest fires. With our dryer climate and higher temperatures, it’s a natural hazard we face each year. Along with the emotional and physical damage that homeowners experience, how do wildfires impact buying and selling real estate? When there is an active fire… When there is an active wildfire in the region, home buyers may not be able to get insurance, which in turn, will prevent them from securing a mortgage. This means that real estate closings will be delayed. As the seller,

Read More

Increasing Awareness Of Domestic Violence in Our Community

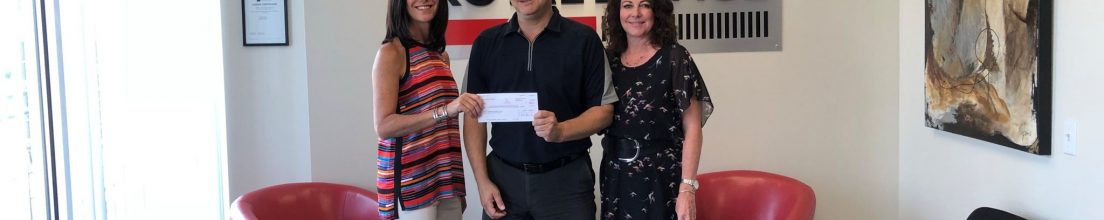

INCREASING AWARENESS OF DOMESTIC VIOLENCE IN OUR COMMUNITY Kelowna Women’s Shelter Support and Education Programs Get Boost from Local REALTORS® Kelowna 25 July, 2018 – Broker Manager, Dave Favell of Royal LePage Kelowna presented a cheque to Executive Director, Karen Mason and Resource Development Coordinator, Kathleen Lemieux of the Kelowna Women’s Shelter. In 2017, Royal LePage Kelowna REALTORS® held fundraising events and donated part of their commissions to The Royal LePage Shelter Foundation throughout the year. The result was more than $7,900 raised to help women and children who are served by the Kelowna Women’s Shelter each year. Supporting women’s shelters

Read More

Are You Falling Behind On Your Home Equity Loan?

Mortgage rates have now been on an upward trend for over a year, and this trend is expected to continue, which could create some trouble for those homeowners with Home Equity Lines of Credit (HELOC).

Read More

Royal LePage Kelowna Real Estate Report for July 2018

Make your home something to be proud of - why wait until you sell to add new life to your home?

Read More

Interest Rates Shouldn't Be All We Focus On

Important things to consider when choosing a lender or a mortgage product.

Read More

Royal LePage Kelowna Real Estate Report for June 2018

The Power of Plants for Home Wellness

The right houseplants can make a real impact on your family's health.

Read More

Legalizing Marijuana – Don't put your house at risk!

Marijuana may become legal in the coming months, but growing it in your house is still a really, really bad idea.

Read More

Royal LePage Kelowna Real Estate Report – May 2018

Last minute spring home maintenance checklist...get your spring checklist ticked before the arrival of hot weather.

Read More